In the world of investing, the price-to-earnings (P/E) ratio is often seen as a barometer of a company’s potential. A high P/E ratio can indicate that investors are willing to pay a premium for a company’s shares, anticipating strong future growth. But what happens when a company that has long commanded a premium valuation sees its P/E ratio decline?

This is the question that came to mind when I stumbled upon a recent tweet: “Asian Paints’ P/E falls below 50 for the first time in 8 years.” This observation prompted me to explore the factors that drive premium valuations and the implications of P/E re-ratings for investors.

After all, what is it that can help an investor separate gold from dust?

What Makes a Company Command a Premium Valuation?

Companies with high growth potential and strong competitive advantages often command premium valuations.

These factors create a “moat” that protects the company from various risk factors. Take HDFC Bank, for example. It enjoys a strong competitive advantage due to its extensive branch network and robust risk management practices. Additionally, HDFC Bank benefits from India’s rising economy and gains market share from public sector banks, resulting in a high growth outlook. These factors have long given HDFC Bank a premium valuation compared to its peers.

However, growth alone is insufficient if there is no profit or visible chance of profit in the future. Companies like Paytm and Zomato, despite having strong moats of network effects (the phenomenon where a product or service gains additional value as more people use it), have suffered investor ire due to a lack of near-term profit visibility. As these companies show promise of profitability, their valuations may improve.

The Case of Asian Paints

Asian Paints has built a strong moat based on its brand and extensive distribution network, coupled with high growth and profitability. However, in recent years, several factors have punctured this moat:

Limited room for growth within the Indian market due to high market penetration

Limited success in overseas expansion, further limiting growth prospects

Increased competition from large business groups like Grasim (Aditya Birla Group), Pidilite, and JSW (Sajjan Jindal Group), attracted by Asian Paints’ high margins

Paint manufacturing is relatively easy, and there’s no competitive advantage in the process itself. Advantages in the paint industry primarily revolve around brand and distribution. Asian Paints faces significant pressure from competition on both fronts and a slow growth environment, which could be leading to the current P/E derating.

The case of Asian Paints highlights the potential challenges that companies may face in maintaining premium valuations over the long term. But what does this mean for investors? To understand the broader implications, let’s take a closer look at how P/E re-ratings can impact investor returns.

The Impact of P/E Re-ratings on Investor Returns

A stock price can be viewed as a multiple of its EPS (Earnings Per Share) and P/E. If a company increases its earnings without changing its P/E, the stock price will rise. Similarly, if the company maintains its earnings but the market assigns a higher P/E, the stock price will still increase. However, true multi-baggers emerge when a company increases its earnings and the market simultaneously assigns a higher P/E. Asian Paints, Titan, and Apar Industries have been examples of such stories.

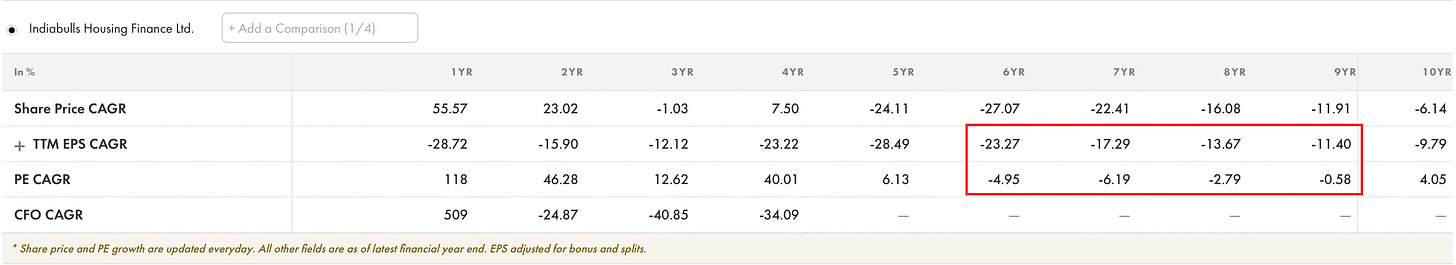

Conversely, a downward P/E re-rating can have a disastrous impact on an investor’s portfolio. A company with decreasing earnings and a downward P/E re-rating can see its prices tumble rapidly, as seen with Indiabulls Housing. Investors in high-growth companies must be extremely cautious when there are signs of the growth story faltering.

Distinguishing Between Undervaluation and Structural Re-rating

Investors must recognize that not every P/E decline is permanent. The key lies in differentiating between an undervalued stock and a structurally re-rated one. Undervaluation often results from heavy market sentiment against a particular company or sector without significant changes in fundamentals. This presents an opportunity for investors to identify potential bargains and capitalize on the market’s temporary pessimism.

On the other hand, structural re-rating stems from a punctured business model or growth limitations. This type of re-rating is more concerning, as it reflects a fundamental shift in the company’s prospects. While the distinction between undervaluation and structural re-rating may seem straightforward in theory, it requires a thorough analysis of the business and its outlook in practice.

Real-world examples can help illustrate this concept. Bajaj Finance, for instance, has experienced periods of undervaluation during sector-wide stress or events like the Covid-19 pandemic. However, the company’s strong fundamentals and growth potential remained intact, allowing it to recover and continue its upward trajectory. In contrast, companies like Dewan Housing faced structural de-rating due to liquidity and regulatory issues, which had a lasting impact on their valuations and prospects.

As an investor, it is essential to remain vigilant when your stocks undergo a re-rating. Take a step back from the market frenzy and objectively assess the underlying reasons for the change in valuation. Conduct a thorough analysis of the company’s business model, competitive landscape, and growth prospects. By identifying potential red flags and distinguishing between temporary setbacks and structural issues, you can make informed decisions and adjust your portfolio accordingly.

Which companies do you believe are currently facing structural de-ratings? How do you approach the task of distinguishing between undervaluation and structural re-rating in your investment process? Let me know in the comments.

Until next time!